E-PINDA

E-PINDA is a digital-based loan management system designed to help institutions, cooperatives, companies, and other institutions manage the entire loan process in an integrated, efficient, and transparent manner. Starting from the application process, verification, approval, to loan repayment, all can be monitored and controlled through one easy-to-use platform – anytime and anywhere.

INTEGRATED SUBMISSION PROCESS

Monitor the entire loan flow, from application to repayment. All data is automatically saved and searchable at any time. Supports multi-level approval and complete history.

MONITORING REAL-TIME

View loan status in real-time, complete with history. Equipped with automatic notifications for important processes. Helps make decisions based on the latest data.

SAVE TIME & OPERATIONAL COST

Automate manual processes that have been time-consuming. Reduce data input errors and the need for physical documents. Digital-based system = high efficiency.

CENTRALIZED LOAN MANAGEMENT

Manage all loan types from one main dashboard. Complete with scheduling, tracking, and analysis features. Suitable for financial institutions, cooperatives, or internal companies.

Cloud-based E-PINDA Application with the Most Complete Features

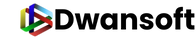

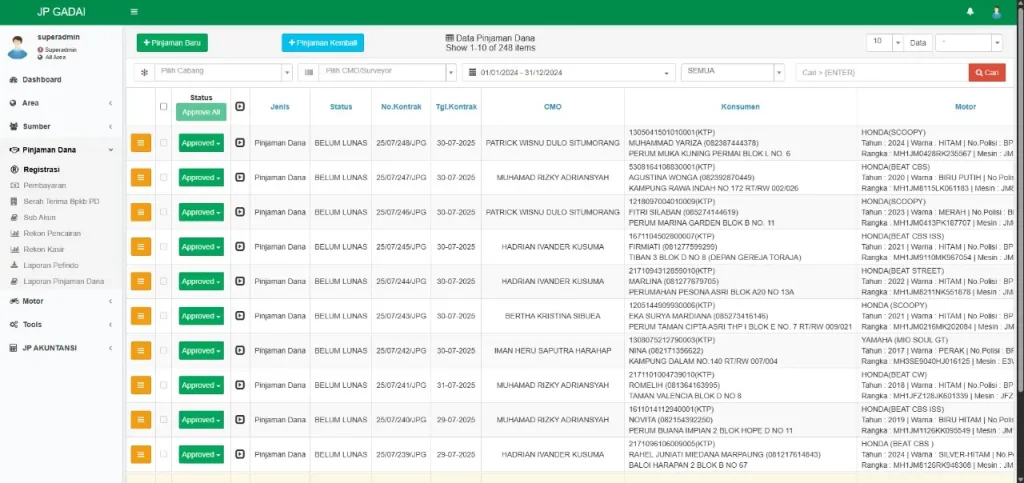

Dashboard

The Dashboard feature displays a real-time summary of loan data, application status, and important statistics. This page helps you monitor system activity quickly and thoroughly.

Steps:

1.After logging in, you will immediately go to the Dashboard (home page).

2.View summaries such as the number of active loans, recent applications, and total repayments.

3.Use graphs or widgets to monitor loan performance.

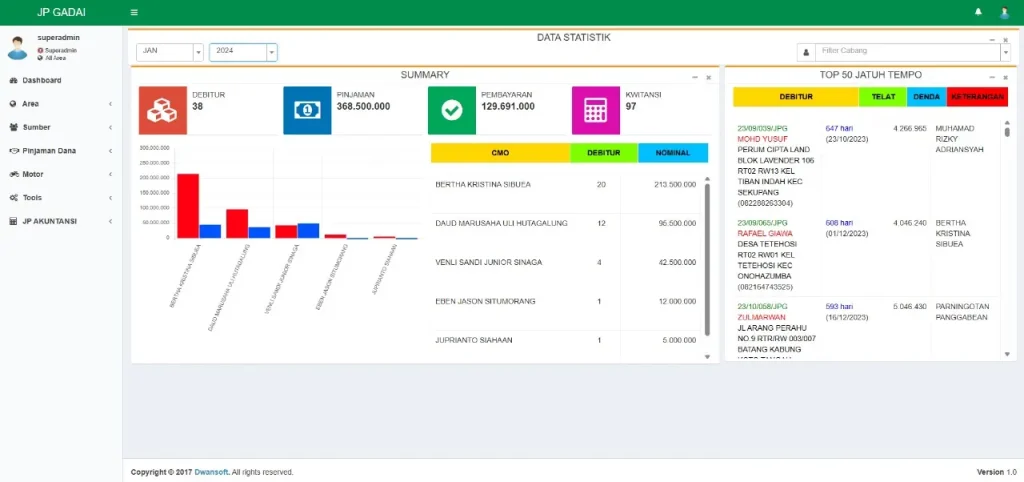

Funds Borrowing

This menu is used to manage the entire process of borrowing funds, from recording applications to disbursements. This feature helps agencies in recording, monitoring, and organizing every loan transaction more neatly, quickly, and structured.

Funds Borrowing Form

This feature is used to record new loan applications into the system. Users can enter borrower details, amount of funds, time period, and other important data in the loan registration process.

Steps:

1.After logging in, click on the Fund Lending → Registration menu.

2.Click the “Add” button to open the new application form.

3.Fill in the borrower’s data, such as name, region, and loan type.

4.Enter the loan amount, tenor, and other supporting information.

5.Once complete, click the “Save” button to record the loan data.

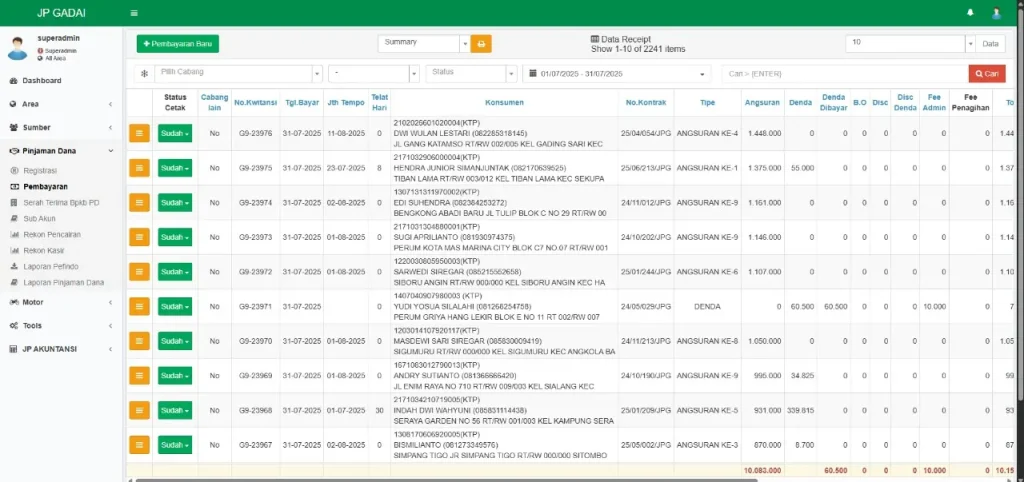

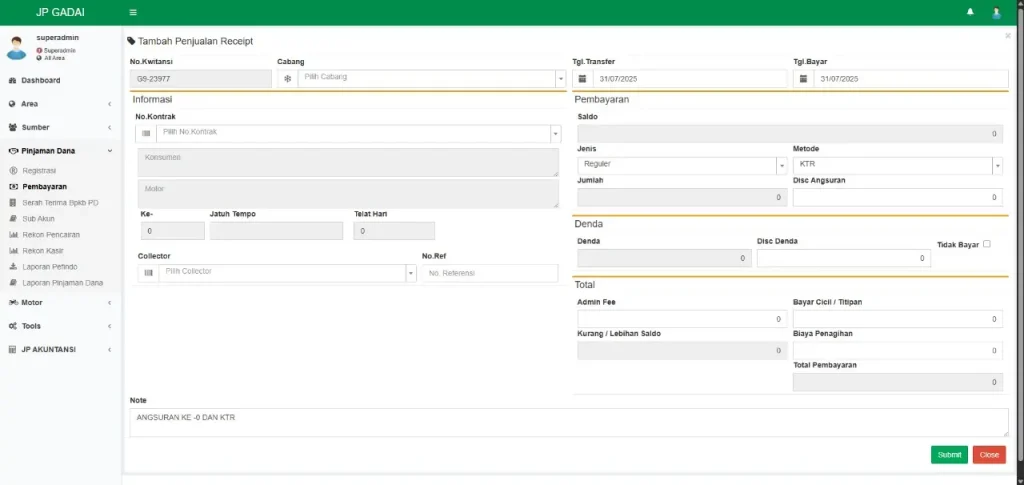

Payments

The Payment feature is used to record the repayment process or installments from the borrower against the funds that have been borrowed. With this feature, you can monitor the amount paid, remaining debt, and payment schedule regularly and accurately.

Payment Form

This feature is used to record installment payments or repayments from borrowers against active loans. The recorded data will automatically update the status and remaining loan balance.

Steps:

1.Click on Borrowing Funds → Payment menu.

2.Click the “Add” button to open the payment form.

3.Select the borrower’s name or loan number to be paid.

4.Enter the payment amount, payment date, and payment method.

5.Click the “Save” button to record the payment transaction.

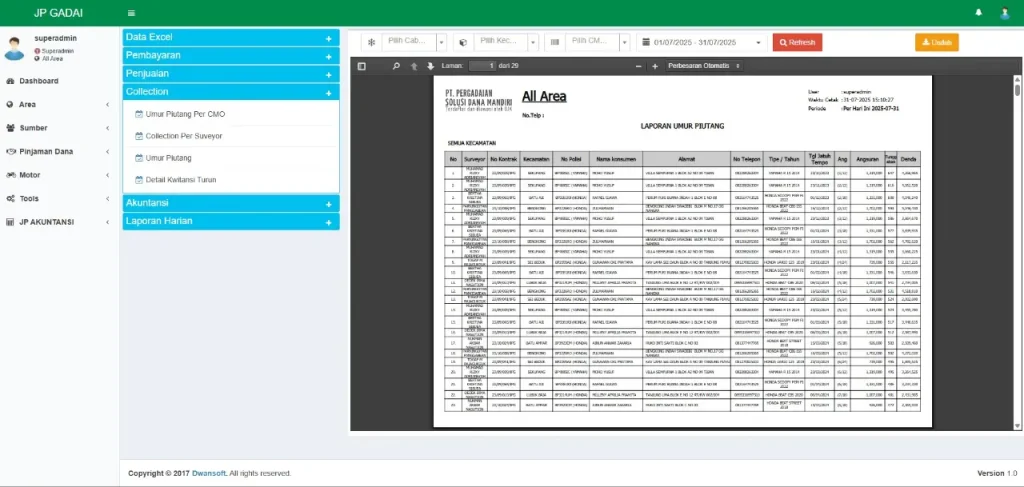

Report

The Report feature serves to present recapitulation data of all loan and payment activities in the system. This report helps users monitor loan performance, print archives, and conduct periodic financial analysis.

Ready to Bring Your App Idea to Life?

Get in touch with the Dwansoft team and start your digital journey with us.